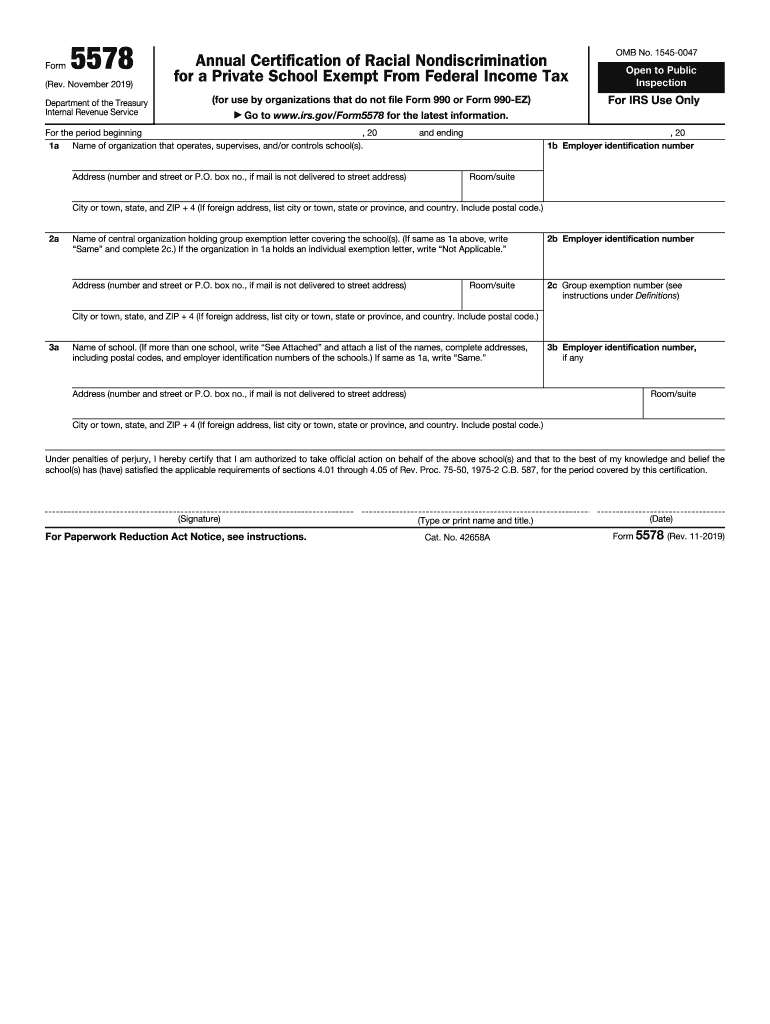

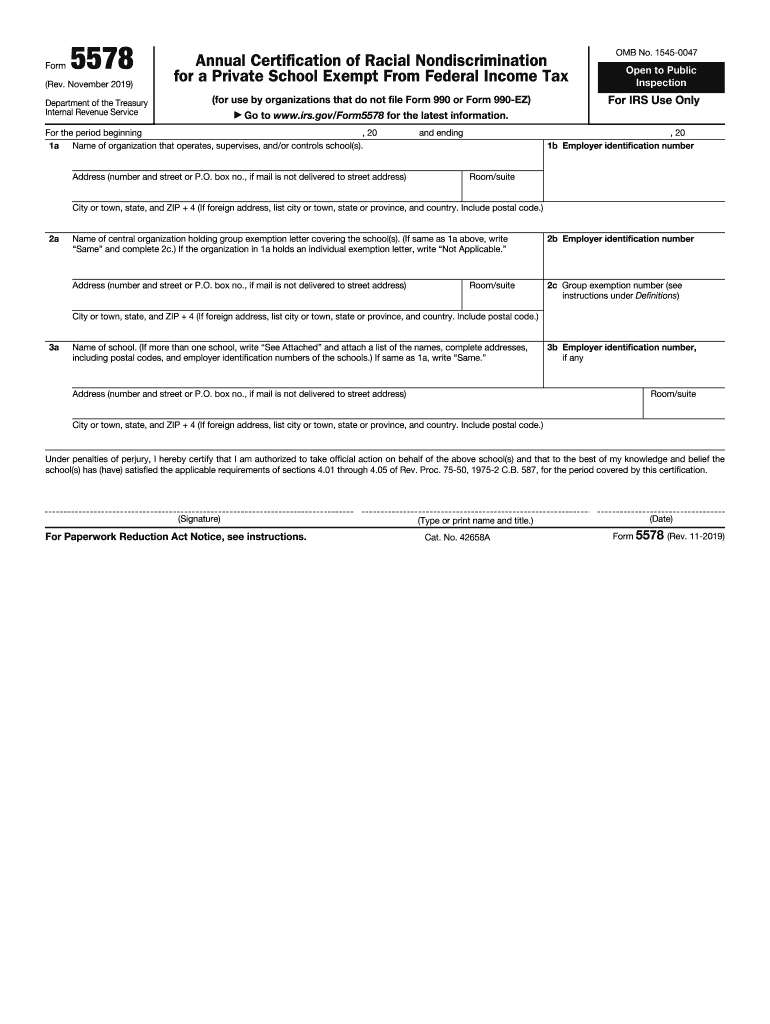

IRS 5578 2019-2024 free printable template

Get, Create, Make and Sign

How to edit federal government tax exempt status online

IRS 5578 Form Versions

How to fill out federal government tax exempt

How to fill out 5578

Who needs 5578?

Video instructions and help with filling out and completing federal government tax exempt status

Instructions and Help about irs 5578 form

Hey guys today I'm going to be going through how to fill out the d2 form hi guys it's Dr wild from vital medicals today I'm going to be going through how to fill out this d2 form a lot of our customers find it really difficult to go through the d2 form, and they ask for help with how to fill it out, but today I'm going to go through exactly how to fill it out if you already have a GB license, and you want to add a provisional entitlement, so that means if you've just got a car license we're trying to go on to either a seven and a half turn or a coach or a truck I hope this video helps so guys this is the d2 form as you can see here and first line here says what are you applying for okay, so you've got your first entitlement, and you've got additional provisional entitlement so let's say somebody has already got a seven and a half ton entitlement already you would click on the additional provisional entitlement however if it is just car license that you have then you would put first...

Fill nondiscrimination notice : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your federal government tax exempt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.